Get a Life Insurance Quote in under 1 minute.

There is nothing more important than protecting your well-being and that of your family. We offer insurance choice from highly rated carriers, along with guidance for selecting the insurance that would best provide for you and your family with the financial resources necessary in the event of the unexpected. Call me at 212.280.2080 to discuss today.

Find the right insurance for you.

- Life Insurance: Making life insurance a key component of your financial plan and help provide for those who depend on you after you’re gone.

- Disability Insurance: Help maintain your income if you become too sick or too hurt to work for an extended period of time.

- Long-Term Care Insurance: Help prepare for the rising cost of long-term care and ensure access to health care or assisted living if you need it.

Life Insurance

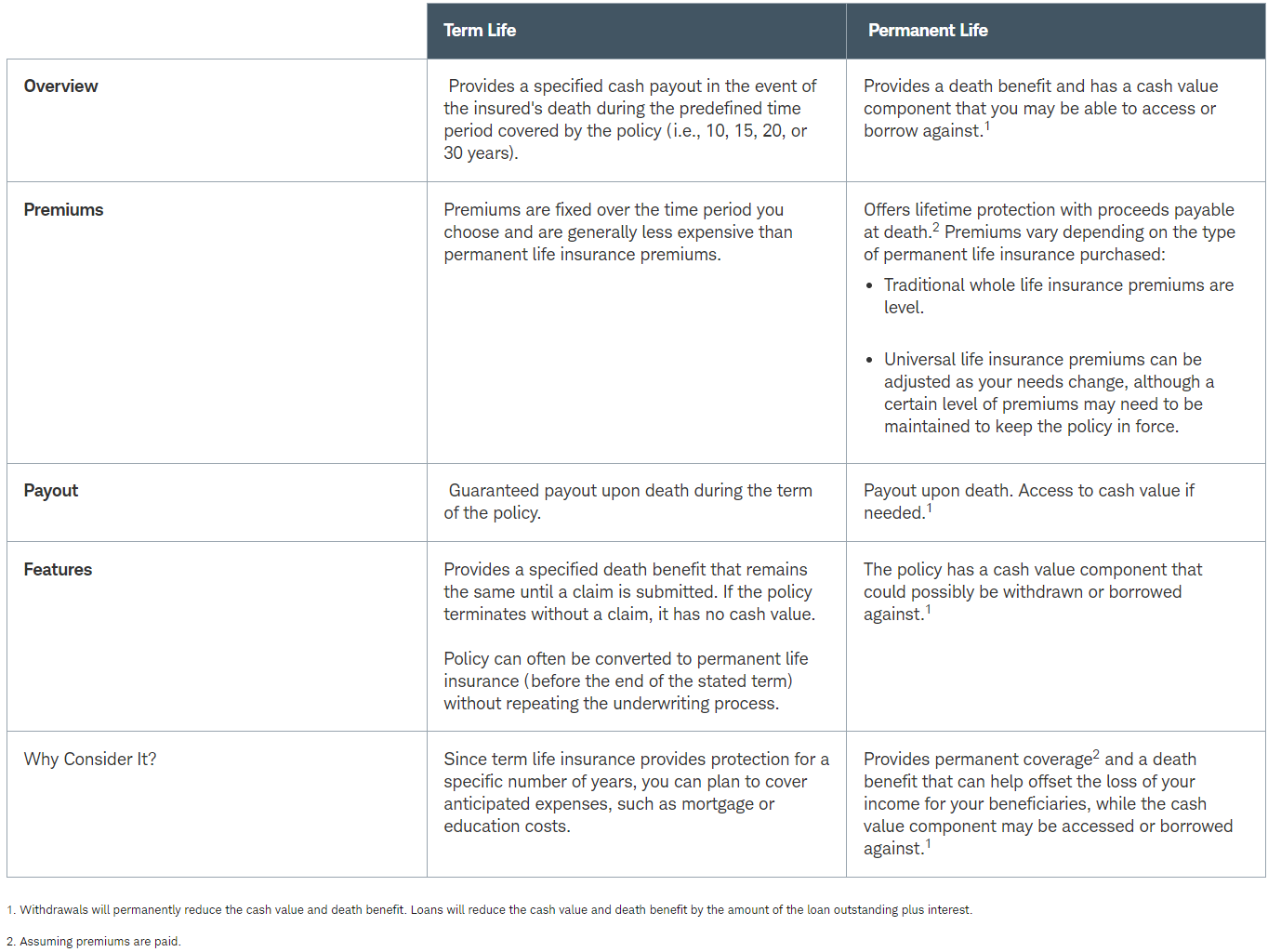

We offer two types of life insurance, term and permanent to provide your family with financial resources in the event you are unable to do so. We provide guidance in selecting the right type of coverage and offer quotes from a wide selection of highly-rated providers.

Compare Term & Permanent Life Insurance

Disability Insurance

It’s important to make sure you have adequate disability insurance to help safeguard your family’s financial stability. Disability coverage helps to provide income replacement if you’re too sick or too hurt to work.

While disability insurance may be available through your employer, the coverage may not be enough to pay living expenses, monthly housing expenses and other personal debt or expenses for the length of time you need. Also, some policies may only allow you to collect benefits if you’re unable to perform any work at all, rather than being unable to do the type of work you did at the time of disability. Additionally, plans through work are not always portable leaving you in a tough spot if you develop a health condition that affects your ability to obtain an affordable health plan down the road.

It’s often a good idea to add to any employer plan with an additional policy. We can help evaluate your existing plan and help explore your options if additional insurance is needed.

Long-Term Care Insurance

Long-term care coverage can play a major role in your family’s future well-being. If you have concerns about rising costs of long-term care and the potential impact on you and your family, long-term care insurance may be right for you.

Long-term care insurance generally covers the costs associated with care needed beyond 100 days, and up to a specified number of days or benefit amount ($). Many policies allow care to be provided in the comfort of your own home, an adult daycare center, assisted living facility, or in a nursing home.

Key reasons to consider long-term care insurance

Long-term care insurance can provide security for the future by helping to:

-

- Obtain quality affordable care

- Preserve financial freedom and independence

- Help provide for the rising costs of long-term care

- Relieve family members and friends from having to provide care

- Safeguard your assets for your spouse, family members or heirs

- Help pay for expenses not covered by Medicare and Medigap

Interested to learn more? Contact me today for more information @ 212.280.2080. Get a Life Insurance Quote in under 1 minute.